According to a recent study by the U.S. Department of Health, “someone turning age 65 today has almost a 70% chance of needing some type of long-term care services in their remaining years.” When it comes to planning a safe and secure retirement, long-term care remains a confusing and unaddressed challenge to many people’s financial security.

What is Long-Term Care?

Long-term care refers to a range of services and support designed to meet the personal and health care needs of individuals who can no longer perform everyday activities independently due to chronic illness, disability, or aging. Everyday activities are referred to as Activities of Daily Living (ADLs). These activities include bathing, dressing, toileting, transferring (from bed to chair), and eating. Unlike medical care, which aims to treat or cure health conditions, long-term care primarily focuses on providing assistance with daily tasks such as housework, taking medication, shopping for groceries, and caring for pets.

Long-term care can take place in a variety of settings:

· Home Care: Services provided in the comfort of an individual’s home. This can include help from family members, home health aides, visiting nurses, or therapists.

· Assisted Living Facilities: Residential communities that offer help with activities of daily living, as well as social and recreational activities. These facilities provide a middle ground between independent living and nursing homes. Continuing Care Retirement Communities (CCRCs) are also gaining in popularity.

· Nursing Homes: Facilities that provide a higher level of medical care for individuals who require constant supervision and assistance. Nursing homes are often staffed with medical professionals who can provide comprehensive care for individuals with severe physical or cognitive impairments.

· Adult Day Care: Centers that offer care and socialization during the day, allowing caregivers to work or take breaks while ensuring their loved ones are looked after.

How Much Does Long-Term Care Cost?

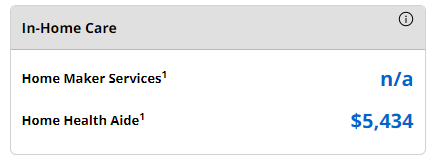

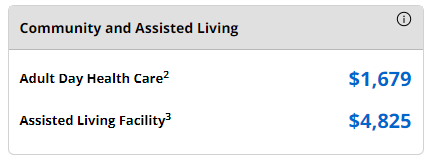

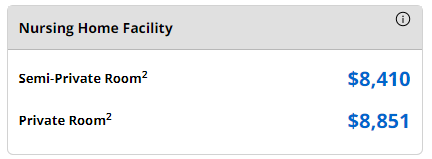

The cost varies based on care setting, geographic location, and level of care required. Using Genworth’s Cost of Care Survey for Knoxville, Tennessee (Zip Code 37919) annual in-home care costs for 2023 averaged $66,690 (assuming 45 hours of care per week) while assisted living averaged $57,900.

Annual Median Costs: Knoxville (2023)

Source: https://www.genworth.com/aging-and-you/finances/cost-of-care

Who Pays for Long-Term Care?

One of the most common misconceptions is that Medicare will pay for long-term care expenses. Medicare pays for limited, short-term care (less than 90 days) that includes skilling nursing and/or therapy. Medicare does not pay for independent or assisted living support services.

Other options to fund long-term care include personal savings, long-term care insurance, reverse mortgages, life insurance options, and annuities. Medicaid may be used by individuals who meet strict income and asset criteria.

Challenges in Long-Term Care Planning

One of the biggest challenges in long-term care planning is the uncertainty of whether and when care will be needed. Some people may never require long-term care, while others may need it for several years. According to this study, women need care longer (3.7 years) than men (2.2 years). This unpredictability makes it difficult to plan effectively.

Moreover, the emotional aspect of considering long-term care can be challenging. Many people find it uncomfortable to think about losing their independence or relying on others for basic needs. However, addressing these concerns early can help ensure that individuals and their families are prepared financially and emotionally if the need for long-term care arises.